More Than 1,400 Unlicensed And Dubious Businesses Got Taxpayer-Funded PPP Loans In Markham: What’s Going On?

MARKHAM, Ill. (CBS) — Remember when Chicago-based restaurant chain Potbelly’s returned $10 million in Paycheck Protection Program loans?

The company took heat because the loans were intended to keep small businesses and companies afloat while they had to close for the COVID-19 pandemic.

There are plenty of questionable small businesses that got the free funds too – and when CBS 2’s Jermont Terry started digging into the data specifically in south suburban Markham, the math just didn’t add up.

The licensed businesses in Markham number 311 in all. A list of them can be printed out on just a few pages.

But the businesses in Markham with owners who got PPP loans with your tax dollars is heavy and a few hundred pages thick. Every one of these owners claims to run some type of business in Markham, and now, the city wants to know where its own cut is.

A quick glance around south suburban Markham reveals signs of economic growth. The nation’s largest Amazon robotic fulfillment facility operates there – generating jobs and much-needed revenue.

“We have some good momentum because Amazon is here, but we also focus on our small businesses as well,” said Markham City Administrator Derrick Champion.

Yet on 159th Street, you can still find plenty of vacant storefronts – available for any small business to move in. It is a prime opportunity, perhaps, for the more than 1,000 small business owners who applied for, and received, taxpayer-funded loans through the federal Paycheck Protection Program.

The goal of that program, again, was to help businesses stay afloat during the pandemic. But there’s just one problem.

“These businesses are questionable – because we don’t know about them,” Champion said.

It is Champion’s job to know which businesses are operating in Markham.

“Individuals saw an opportunity, and they took advantage of it,” he said.

It all started when CBS 2 started digging into data from the federal government about PPP loans. Something immediately stood out.

If taxpayers pumped at least $28 million into local business loans, how are there still so many empty storefronts?

“We don’t understand,” Champion said. “How could Markham have this many businesses, and we’re not seeing applications come through?”

According to the data, 1,733 loans were paid out to people who say they run businesses in Markham – and should have city stickers confirming it. Once again, there’s just one problem.

City records reveal only 311 businesses are licensed to operate in Markham. That leaves 1,422 that got PPP loans unaccounted for.

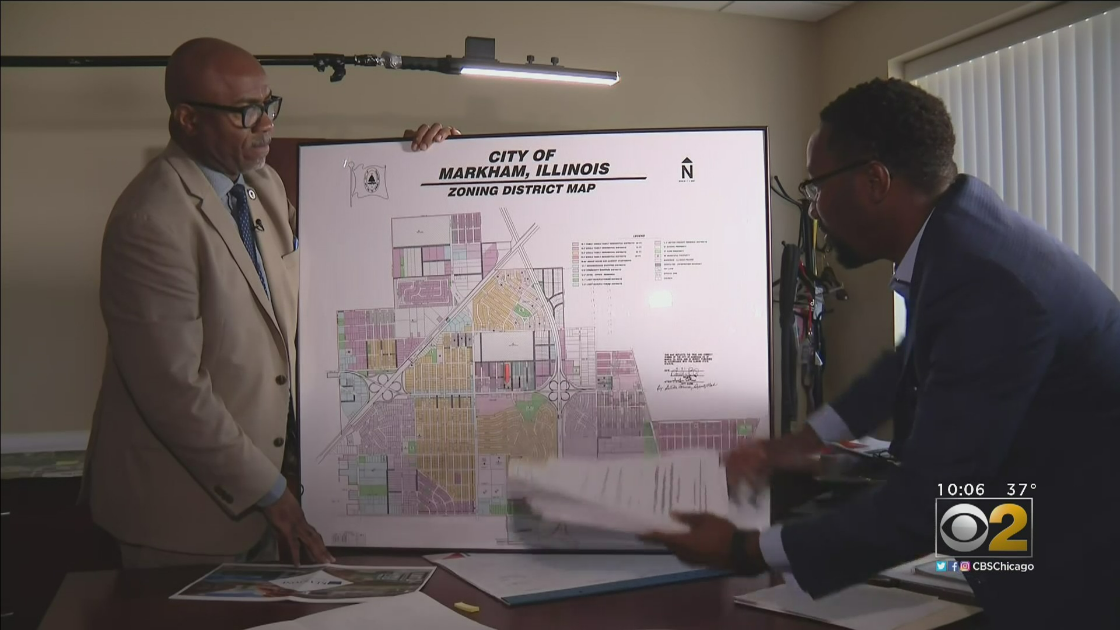

Champion showed Terry a Markham zoning map, which breaks down where businesses may operate.

(Credit: CBS 2)

Terry: “If you really have 1,422 legitimate businesses operating within all these zones, you should have way more money coming in.”

Champion: “A lot more money.”

Terry: “The bottom line is what, when you see this list?”

Champion: “When I see that list, it’s letting me know that something is going on.”

We thought the same thing, so we started digging.

Our first discovery was that the vast majority of people granted PPP loans in the names of small businesses all run the businesses from their homes. That makes sense for some. Champion agreed that if someone has a tax consultant business they operate from home, it is not an issue.

But how about a business listed as a sports complex, but with address that turns out to be a house? Terry went to that house to find out what was going on.

(Credit: CBS 2)

Terry: “Hey, how you doing, ma’am? I’m with Channel 2 News. I’m trying to sign up for the fitness sports complex that’s here.”

Woman In House: “OK?”

Terry: “Where do I sign up?”

Woman: “I have no idea.”

Terry: “Are you familiar with it?”

Woman In House: “No, I’m not. What is this for?”

Terry: We’re “trying to get information regarding the sports complex. They have this listed as a sports complex. Is this a sports complex?”

Woman: “No, it’s just a house.”

Terry: “Just a house? And there’s nothing in the basement or anything of that nature?”

Woman: “I don’t even have a basement.”

So there is clearly no fitness center operating in that house, in middle of a residential neighborhood. Yet the man who lived in that house previously managed to get $20,000 of your tax dollars by simply applying for A PPP loan.

Terry: “You didn’t get any of the money, right?”

Woman: “No, I haven’t seen him – he left here last year, I want to say.”

Terry: “So is this coming as a shock to you?”

Woman: “A little bit.”

Meanwhile, Champion said when someone who operates such a dubious business that received $20,000 in PPP loans and has not applied a single dime toward the City of Markham, Champion said that amounts to fraud.

“It’s a clear indication,” he said. “We have people living in residential areas saying they have a sports complex. We know for a fact that any kind of sports fitness business is not even allowed on this particular block.”

And it doesn’t stop there. Records show the owner of some farmland in Markham received two PPP loans just shy of $50,000 to keep a hotel running. But there’s no hotel or motel there. Just farmland. And that amount of green is a lot of money to keep goats fed, considering that was all we spotted on the land.

(Credit: CBS 2)

And then there’s this – let us introduce you to Markham police Officer Kenneth Muldrow. When Terry confronted him, he denied being Officer Muldrow.

(Credit: CBS 2)

Officer: “I’m not Officer Muldrow, though.”

Terry: “You are.”

Officer: “No I’m not. What do you need?”

He is the same Kenneth Muldrow who applied for and received $20,000 of taxpayer money to keep his landscaping company going through the pandemic.

The location listed on the loan application is “16313 Kedzie.” That is the address for the Markham Police Department.

Terry: “I want to ask you about your lawn care service you have. I’m trying to figure out why your lawn care service is not registered as a licensed business with the City of Markham. Can you explain yourself?”

Officer: (officer) “I don’t have a lawn care service.”

Terry: “Well, you got a PPP loan that was paid out for $20,000 back in March, so If you don’t have a lawn care service, then who does? And it was registered here to police department, sir.”

That was the end of Terry’s conversation with Officer Muldrow. While he did not want to explain any further with Terry, he will have to explain to someone.

“We’re putting them on notice,” Champion said.

The city said if any of these businesses are ghost businesses, they are going to have to pay up. All told, the business owners listed on the PPP loan applications owe nearly $600,000 in unpaid business license fees – even if they are legitimate.

“We want to make sure that we’re regulating these businesses and we’re aware of these businesses,” Champion said. “We owe it to the City of Markham.”

Markham refuses to let up. On Wednesday, the Markham City Council is expected to introduce an ordinance to further regulate at-home businesses. We are told that if you are running a legitimate business, you will need to show proof.

MORE NEWS: Family Honors Murder Victim Marlen Ochoa And Her Infant Son On Día De Los Muertos

CBS 2 will be at the City Council meeting to talk about all the specifics that will be introduced as part of the ordinance. But if those 1,422 businesses are legitimate, the city says it is time to prove it.

Source: CBS Chicago